FHA Loan Programs

The Federal Housing Administration, generally known as "FHA", provides mortgage insurance on loans made by FHA-approved lenders throughout the United States. It is the largest insurer of mortgages in the world; insuring over 34 million properties since its inception in 1934.

FHA loans are a great option for borrowers that do not have a lot of cash on hand for a down payment and may need some flexibility in qualification guidelines.

Features include:

- low 3.5% down payment

- most of your closing costs and fees can be included in the loan

- low monthly mortgage insurance

- no maximum income/earning limitations (there are investor overlays to this guideline)no cash reserves if loan meets FHA guidelines

- minimum FICO score 620 (with investor overlays)

- no landlord rating required

- gifts are acceptable

- seller credits are allowed

- non-occupant cosigners okay to help qualify

- fixed rate and ARM loans available

FHA Streamline Refinance

If you already have a FHA Mortgage and you are current on your payments and in good standing, then a Streamline Refinance may be a great option for you to lower your interest rate and monthly payments.

Features include:

- appraisal usually not required

- very little paperwork

- no credit check, income verification, employee verification, or underwriting fee

- easily increase or decrease the length of the term of your existing loan

- little or no out-of-pocket costs

Please note: Cash-out is not an option on this type of refinance and you must have opened your current loan at least six months prior to refinancing.

FHA 203(k) Rehab Loan

FHA’s 203(k) loan program provides borrowers an affordable, stable financing solution that combines the purchase or refinance of the home along with the costs of the improvements into a single loan.

Features include:

- FHA guidelines apply

- opportunity to borrow against the value of the home after improvements

- low down payment requirements for purchase transactions

- flexible credit qualifying fixed-rate and adjustable-rate mortgages up to 30-year terms

- fully assumable loans to qualified borrowers

- owner-occupied 1-4 unit properties, PUDs, condos and REO properties

- lower initial monthly payments with optional temporary interest rate buy down

Eligible properties include:

- attached and detached single family residences, condos, and PUDs

- 2-4 unit properties

Virtually any kind of improvement is eligible provided it becomes a permanent part of the real property and adds value, for instance:

- additions to the structure

- kitchen or bath remodels

- finished basement or attic

- patios, decks or terraces

- roofing and landscaping

- safety, energy efficiency and electrical upgrades

- handicapped accessibility improvements

Luxury items are not eligible:

- swimming pools, hot tubs, tennis courts, gazebos, barbecue pits, saunas or alterations to support commercial use

VA Loans

VA guaranteed loans are made by lenders and guaranteed by the U.S. Department of Veteran Affairs (VA) to eligible veterans for the purchase of a home. The guaranty means the lender is protected against loss if you fail to repay the loan. In most cases, no down payment is required on a VA guaranteed loan and the borrower usually receives a lower interest rate than is ordinarily available with other loans.

Other benefits of a VA loan include:

- Negotiable interest rates.

- Closing costs are comparable and sometimes lower - than other financing types.

- No private mortgage insurance requirement.

- Right to prepay loan without penalties

- The Mortgage can be taken over (or assumed) by the buyer when a home is sold.

- Counseling and assistance available to veteran borrowers having financial difficulty or facing default on their loan.

Although mortgage insurance is not required, the VA charges a funding fee to issue a guarantee to a lender against borrower default on a mortgage. The fee may be paid in cash by the buyer or seller, or it may be financed in the loan amount.

A VA loan can be used to buy a home, build a home and even improve a home with energy-saving features such as solar or heating/cooling systems, water heaters, insulation, weather-stripping/caulking, storm windows/doors or other energy efficient improvements approved by the lender and VA.

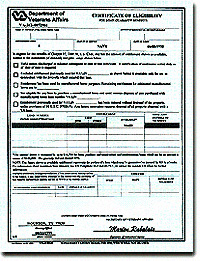

Veterans can apply for a VA loan with any mortgage lender that participates in the VA home loan program. A Certificate of Eligibility from the VA must be presented to the lender to qualify for the loan.